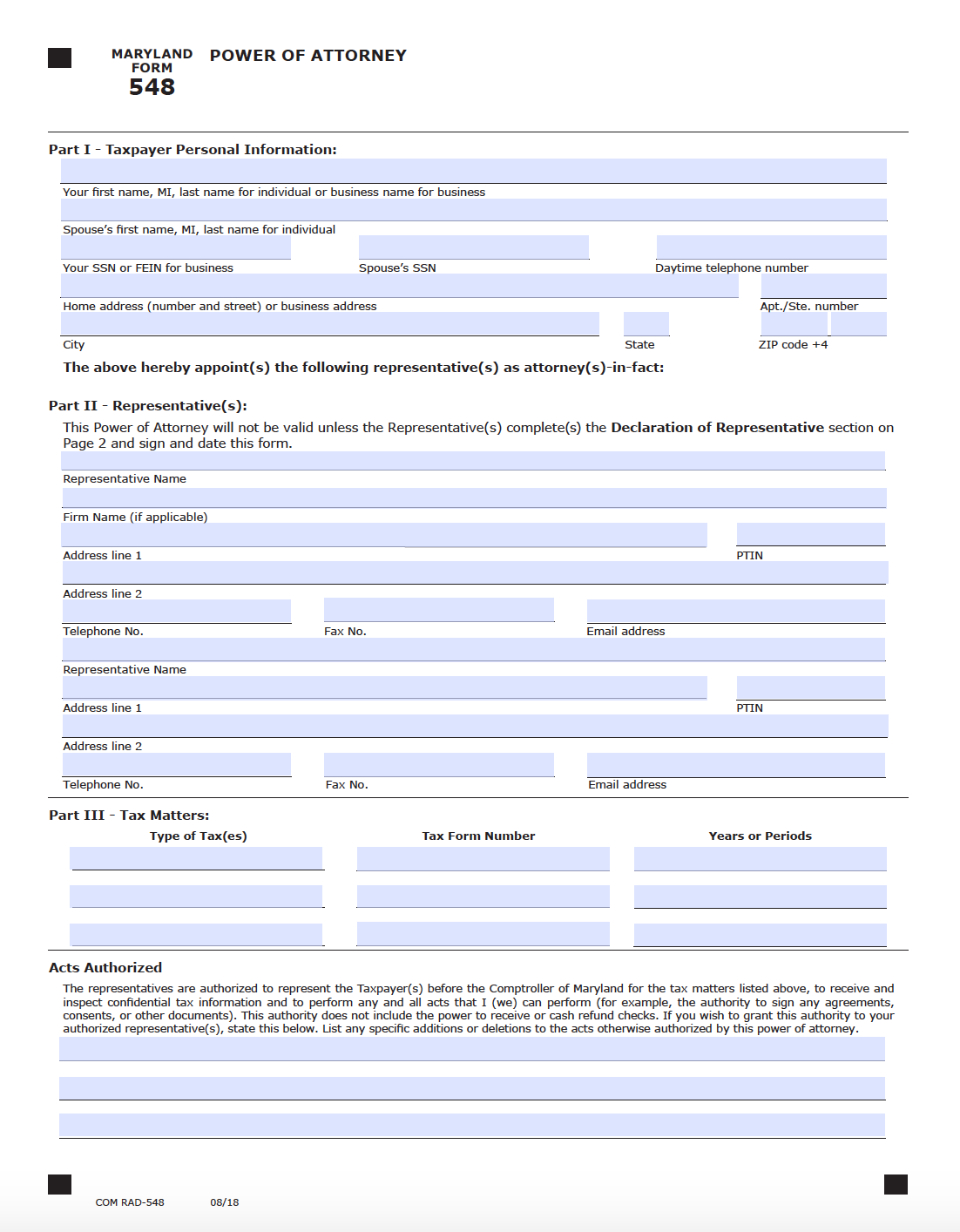

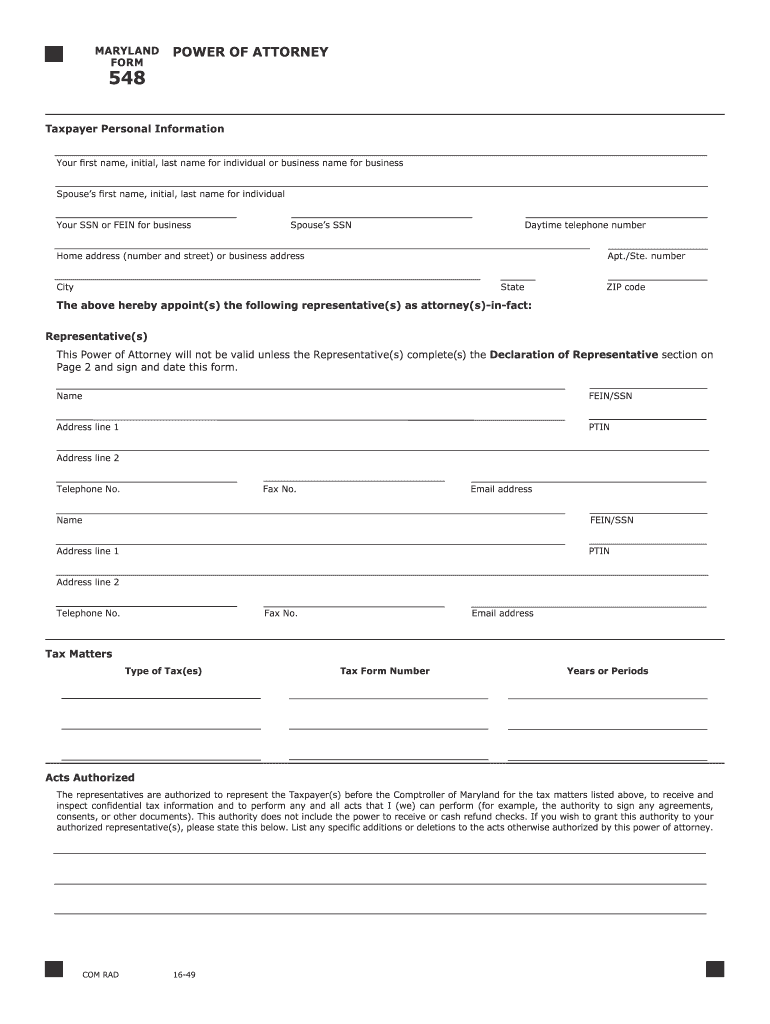

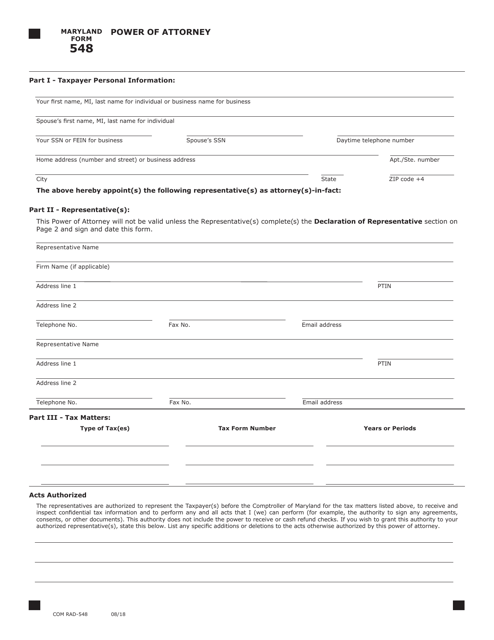

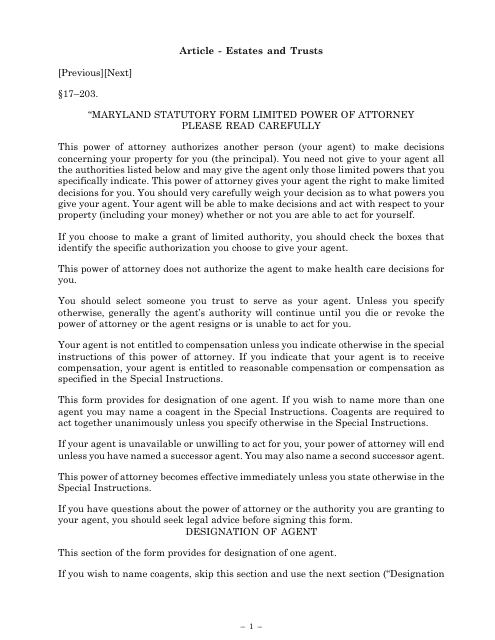

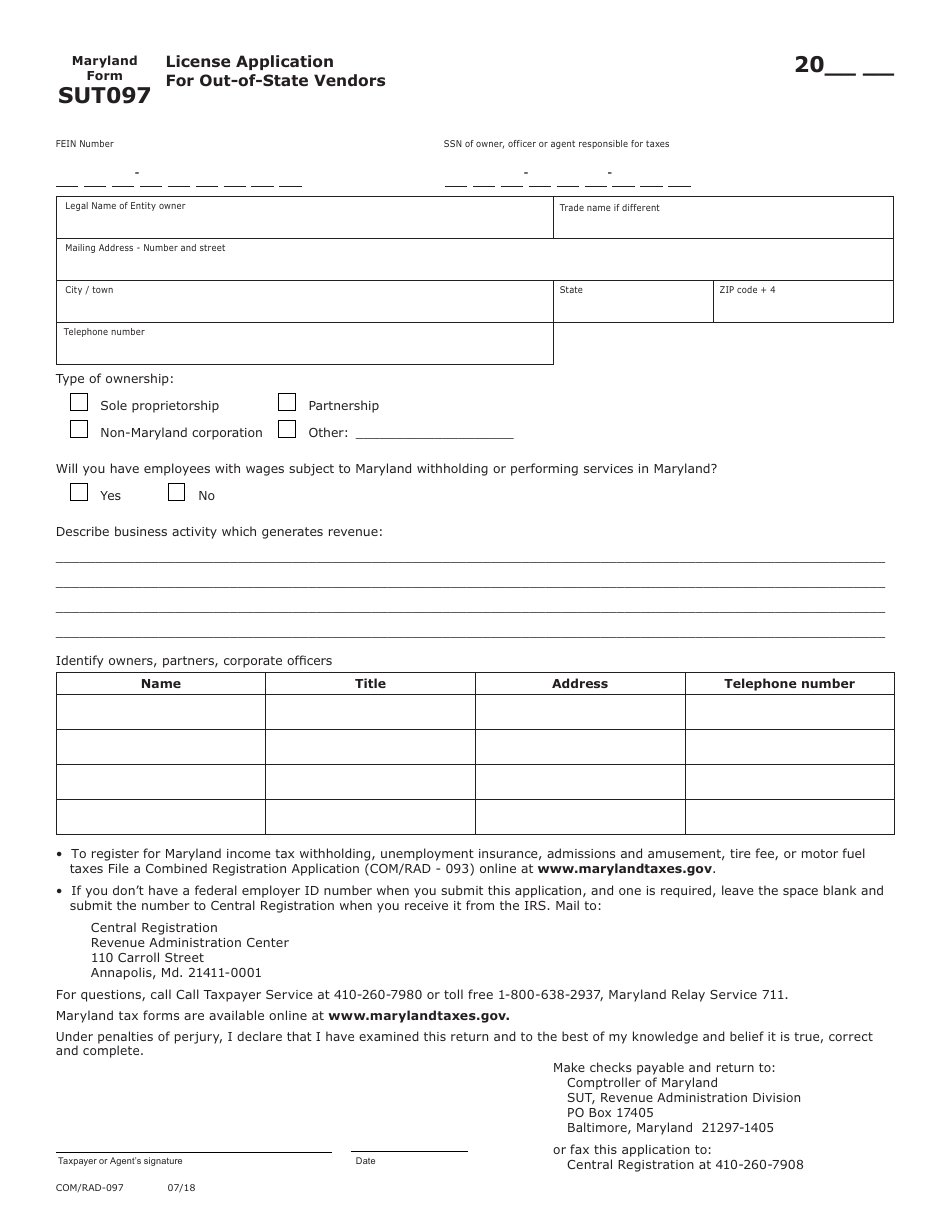

Maryland tax power of attorney form 548 certified by the comptroller of maryland revenue administration division the maryland tax power of attorney form 548 is a form that comprehensively addresses the topic of tax focused power of attorneys in the state.

Md power of attorney form 548.

You may use form 548 for any matters affecting any tax or fee administered by the comptroller of maryland and the power granted is limited to these tax matters.

Share on twitter facebook google pinterest.

You may use form 548 for any matters affecting any tax or fee administered by the comptroller of maryland and the power granted is limited to these tax matters.

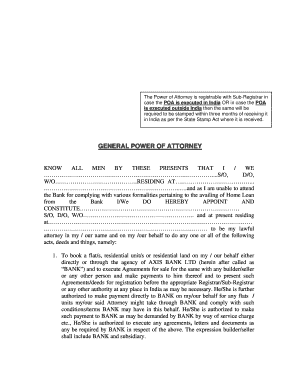

Tax power of attorney maryland form 548 adobe pdf the maryland tax power of attorney form is used by individuals to appoint a representative to handle the filing of their taxes.

A taxpayer or taxpayers can fill out the form as a means of letting the comptroller.

You may use form 548 for any matters affecting any tax or fee administered by the comptroller of maryland and the power granted is limited to these tax matters.

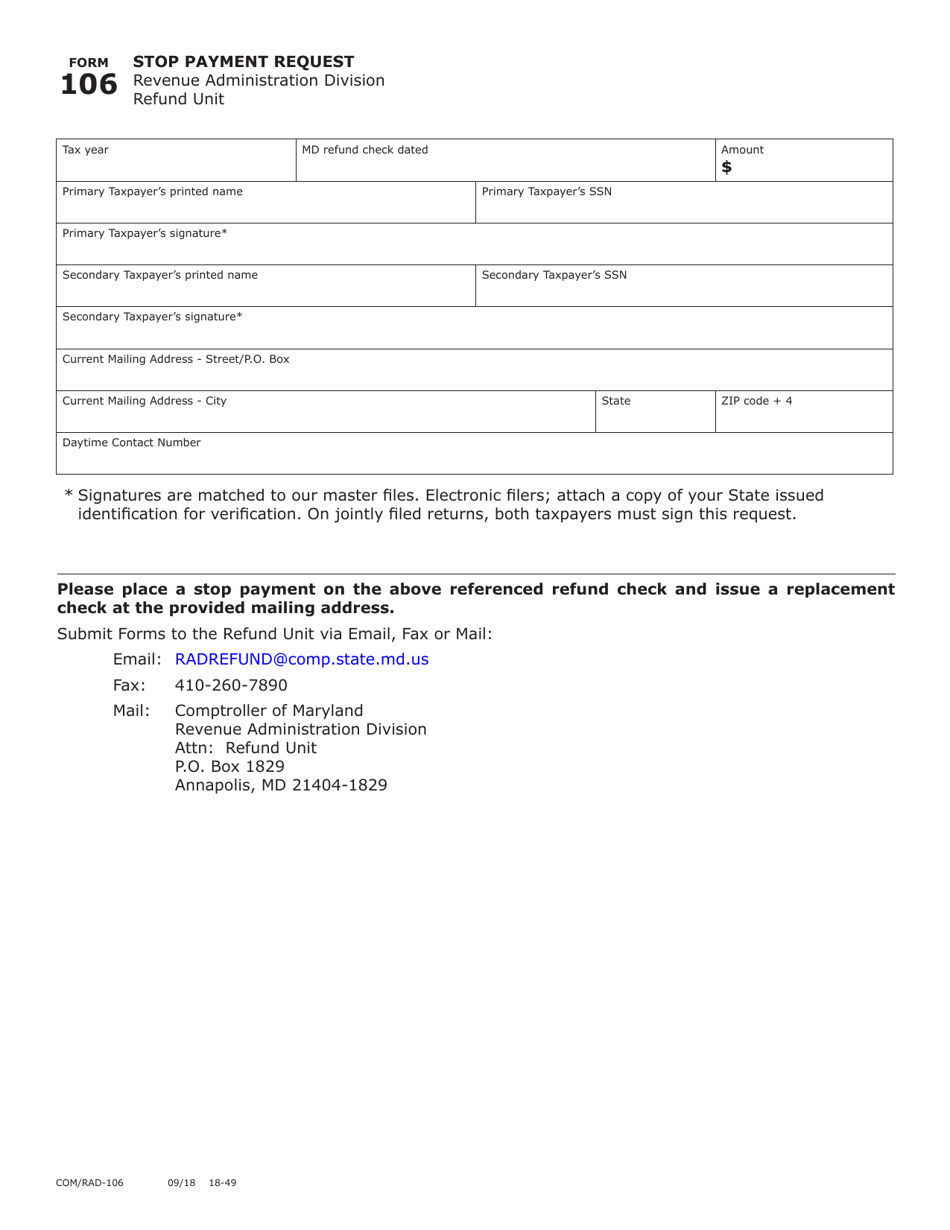

Form 548 power of attorney com rad 548 08 19 taxpayer s ssn or fein taxpayer s name retention revocation of prior power s of attorney by filing this power of attorney form you automatically revoke all earlier power s of attorney on file with the comptroller of maryland for the same tax matters and years or periods covered by this document.

You may use form 548 power of attorney to appoint one or more individuals to represent you in tax matters before the comptroller of maryland.

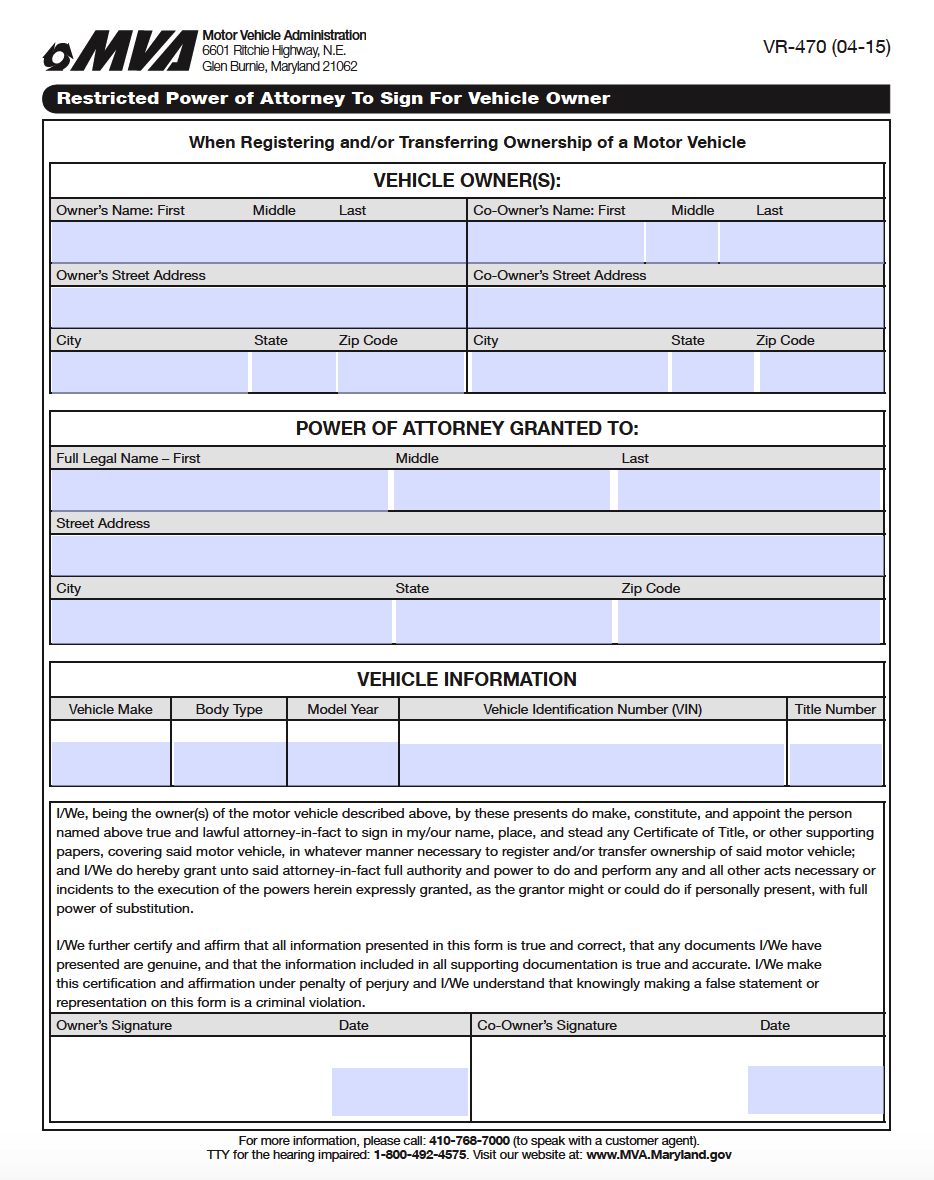

Medical durable power of attorney form maryland.

Maryland power of attorney form 548.

As such taxpayers may select a tax specialist or another individual or entity to file their taxes on their behalf.

You may use form 548 power of attorney to appoint one or more individuals to represent you in tax matters before the comptroller of maryland.

21 posts related to state of maryland power of attorney form 548.

State of maryland power of attorney form 548.

You may use form 548 power of attorney to appoint one or more individuals to represent you in tax matters before the comptroller of maryland.

Maryland power of attorney form 548p.

Form october 17 2020 00 14.

The tax agent can be any third party however individuals will typically choose a certified professional accountant cpa or tax attorney.

All earlier power s of attorney on file with the comptroller of maryland for the same tax matters and years or periods covered by this document.